The Path to a Greener Future: Understanding Sustainable Development In an era where environmental challenges and resource depletion are becoming increasingly evident, the concept of sustainable development has gained significant importance. Sustainable development aims to meet the needs of the present without compromising the ability of future generations to meet their own needs. This blog post will explore the principles, goals, and strategies of sustainable development, highlighting its critical role in ensuring a balanced and healthy future for our planet. "Transforming our world: The path to sustainable development." What is Sustainable Development? Sustainable development is a holistic approach that integrates economic growth, environmental protection, and social equity. It seeks to create a harmonious relationship between human activities and the natural world, ensuring that resources are used efficiently and responsibly. Definition: The most widely recognized de...

Welcome back! Here I am as promised to teach you regarding posting compound entries into ledger. Well I will just use the same transactions which I explained in the lesson How to record compound journal entries? Part – 1 and Part – 2. Here I m taking only four transactions but it will cover all types of ledger account. (I.e. self ledger, general ledger, debtor ledger and creditor ledger.

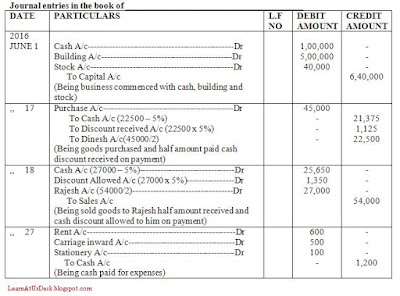

EXAMPLE PROBLEM:

SOLUTION:STEP – 1 recording transactions in journal

Step – 2 posting into ledger

Before posting into ledger let me first explain you little so you understand these complicated entries easily.

On June 1 business is started with cash, building and stock, all these are assets ( general ledgers) and comes in the business so each account is opened separately and are debited as To Capital A/c. Always remember for every debit there is an equal credit so we have to credit these transactions as well. As these assets are brought by businessmen, he is the giver, so his personal account is opened known as Capital account (self ledger) and credited three times separately as By Cash A/c, By Building A/c, By Stock A/c with their respective amounts.

On June 17 Purchase is made so goods are coming in the firm, here in this transaction goods are coming in full but in return only half of the payment is made, on which discount is also received and other half of the payment is due to Dinesh. So separate Purchase account, Discount Received account (general ledgers) and Dinesh account (creditor’s ledger) is opened. We already have cash account so we need not opened it again. First Purchase account is debited as To Cash A/c, To Discount received A/c and To Dinesh A/c separately with their respective amounts. Then cash account, Discount Received account and Dinesh account is credited as By Purchase A/c individually with their respective amounts not with full amount of Purchase.Ok!

On June 18 Sales is made so goods are going out of the firm, but here as well goods are going out in full but in return only half payment is received in cash, on which discount is allowed and other half of the payment is due from Rajesh. So separate sales account, Discount Allowed account (general ledgers) and Rajesh account (debtor’s ledger) is opened. We already have cash account so we need not opened it again. First Sales account is credited as By Cash A/c, By Discount Allowed A/c, and Rajesh A/c separately with their respective amounts. Then cash account, Discount Allowed account and Rajesh account is debited as To Sales A/c individually with their respective amounts not full amount of Sale.

On June 27 cash is paid for Rent, carriage, and stationery, all these are expenses so separate Rent account, Carriage account and stationery account (general ledger) is opened. We already have cash account so we need not opened it again. As cash is going out of the firm so cash account is credited as By Rent A/c, By Carriage A/c, and By Stationery A/c, separately with their respective amounts. Then Rent account, Carriage account and stationery account are debited as To Cash A/c individually with their respective amounts.

Here’s, how all the ledgers will be like

First cash account is opened, you can see, in every transaction cash is involved, so you should always close this account after posting all transactions given in the question.On Jan 1 there are four accounts involved cash account, building account, stock account and capital account is opened.

On Jan 17 there are four accounts involved including cash account, remember cash account is prepared only once, so for this transaction separate purchase account, discount received and Dinesh account is opened.

On Jan 18 there are four accounts involved including cash account, for this transaction separate sales account, discount allowed account and Rajesh account is opened.

On Jan 27 there are four accounts involved including cash account, and for this transaction separate rent account, carriage account and stationery account is opened.

Comments

Post a Comment