The Path to a Greener Future: Understanding Sustainable Development In an era where environmental challenges and resource depletion are becoming increasingly evident, the concept of sustainable development has gained significant importance. Sustainable development aims to meet the needs of the present without compromising the ability of future generations to meet their own needs. This blog post will explore the principles, goals, and strategies of sustainable development, highlighting its critical role in ensuring a balanced and healthy future for our planet. "Transforming our world: The path to sustainable development." What is Sustainable Development? Sustainable development is a holistic approach that integrates economic growth, environmental protection, and social equity. It seeks to create a harmonious relationship between human activities and the natural world, ensuring that resources are used efficiently and responsibly. Definition: The most widely recognized de...

When business transactions are very few, there is only ☝️one journal, wherein all the business transactions are recorded.✍ But what if the business is at large scale and there are large number of transactions?🤔

Well, to be very honest with you, recording large number of transactions in one journal and then posting those into ledger will be very inconvenient and time consuming. 😥To overcome this difficulty, big business concerns have introduced the system of subsidiary books.😀

Subsidiary books are books of original entry as all transaction recorded in these books before they are recorded in respective accounts of ledger.

1. Purchase Book: This book records all credit purchases of goods.

2. Purchase return Book: This book records transactions in which goods purchased on credit are returned.

3. Sales Book: This Book records credit sale of goods.

4. Sales return Book: This book records transactions in which goods sold on credit are returned.

5. Cash Book: This book records all cash transactions when ever cash is received or paid.

6. Bill receivable Book: This book records the bills of exchange, whose amounts are receivable.

7. Bill payable Book: This book records the bills of exchange whose amounts are payable.

8. Journal proper: This book records all those transactions for which there is no separate subsidiary books.

Later Purchase book is closed periodically and entries there from are posted to the ledger as under:

Debit the purchase Account with the totals as “To Sundries as per Purchase book”. And

Debit note: A ‘Debit Note’ is a serial wise document, bill or statement sent to the person to whom goods are returned or from whom an allowance is claimed. This statement informs him that his account is debited to the extent of the value of goods returned or allowance claimed.

Like the purchase book the purchase return book is closed periodically and the entries there in are posted to the ledger as under:

Debit supplier account to whom goods are returned as “To purchase return A/c”.

Credit the purchase return Account with the periodical total as “By Sundries”.

Sales book is closed periodically and entries there from are posted to the ledger as under:

Debit customer’s Account as “To Sales A/c”

Credit sales account with periodical total as “By Sundries as per sales book”.

Credit Note: When the seller receives back goods from the purchaser along with a Debit Note the seller has to acknowledge the same by sending a Credit Note confirming the acceptance of the debit note. In other words it is a statement sent by the seller to the purchaser after the receipt of goods returned by purchaser. We call it a Credit Note, because the customer’s account is credited with the amount written therein.

Like sales book, this book is also closed periodically and entries are posted to the ledger as under:

Debit Sales return account with the periodical total as “To Sundries”

Credit customer account with the individual amount as “By Sales return A/c”

Now let me explain the above transactions one by one:

On Jan 1 goods are purchased from Madan that means it is a credit transaction so we will record it in purchase book, remember only credit transactions are recorded in purchase book. And you must remembered that we can’t use purchase in purchase book instead we will write the name from whom we purchase; this rule is applicable to all books. Here there is a trade discount of 10% on 3000 worth of goods so we will deduct it and record the net amount only that is 2,700 - because no separate entry is made for trade discount.

On Jan 2 we return goods worth 200 to Madan so it is a purchase return, remember there was a trade discount so we will deduct trade discount from the purchase return as well, that is 180.

Again On Jan 2 sold goods to Madan that means it is a credit transaction so we will record it in sales book, as Madan with its respective amount.

On Jan 5 goods are returned by Madan so recorded in sales return book, as Madan with its respective amount.

On Jan 13 goods are sold to Hari, it should be recorded in sales book. Here there is a trade discount of 10% on 2000 worth of goods so we will deduct it and record the net amount only that is 1,800, because no separate entry is made for trade discount.

On Jan 14 Hari return goods which was sold to him that means we will record it in sales return book, remember there was a trade discount so we will deduct trade discount from the sales return as well that is 90.

On Jan 19 sold goods to Madan so we will record it in sales book, as Madan with its respective amount.

On Jan 28 sold goods to Hari so we will record it in sales book, as Hari with its respective amount.

On Jan 29 goods are purchase from Hari so we will record it in Purchase book as Hari with its respective amount.

On Jan 30 goods are return to Hari so it is a purchase return. We will record it in purchase return book, as Hari with its respective amount.

On Jan 1 and 29 there was a purchase made so recorded in purchase book.

On Jan 2 and 30 there were purchase return so recorded in purchase return book.

On Jan 2, 13, 19, and 28 sales were made so recorded in sales book.

On Jan 5 and 14 there were sales return so recorded in the sales return book.

Later All four books are closed periodically and entries there from are posted in to separate ledgers.

Well, to be very honest with you, recording large number of transactions in one journal and then posting those into ledger will be very inconvenient and time consuming. 😥To overcome this difficulty, big business concerns have introduced the system of subsidiary books.😀

WHAT ARE SUBSIDIARY BOOKS?

Under the system of subsidiary books, instead of maintaining only one book of original entry called Journal for all types of transactions, several books of original entry called Subsidiary Books are maintained.Subsidiary books are books of original entry as all transaction recorded in these books before they are recorded in respective accounts of ledger.

TYPES OF SUBSIDARY BOOKS

The following are the various types of subsidiary books:1. Purchase Book: This book records all credit purchases of goods.

2. Purchase return Book: This book records transactions in which goods purchased on credit are returned.

3. Sales Book: This Book records credit sale of goods.

4. Sales return Book: This book records transactions in which goods sold on credit are returned.

5. Cash Book: This book records all cash transactions when ever cash is received or paid.

6. Bill receivable Book: This book records the bills of exchange, whose amounts are receivable.

7. Bill payable Book: This book records the bills of exchange whose amounts are payable.

8. Journal proper: This book records all those transactions for which there is no separate subsidiary books.

Well it’s not possible to explain all the subsidiary books in one post so in this post I will explain you only 4 books i.e. (purchase book, purchase return book, sales book and sales return book) in detail. Ok let’s divine in!😀

1. PURCHASE BOOK

This is also called purchase day book, purchases Journal or invoice book. It is used for recording only credit purchase of goods. Always remember,Cash purchases of goods/assets are to be recorded in the cash book and not in purchase book. Credit purchase of Assets are also not recorded in purchase bookLater Purchase book is closed periodically and entries there from are posted to the ledger as under:

Debit the purchase Account with the totals as “To Sundries as per Purchase book”. And

Credit the supplier Account with the total amount of Purchase made from him as “By Purchase A/c”.

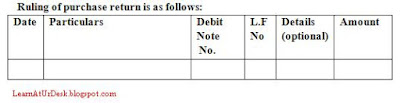

2. PURCHASE RETURN BOOK

If the goods purchased are defective or damaged or not up to the sample shown, the trader will return such goods to the supplier. Such returns to the supplier are entered in a separate book called Purchases Return book. While returning goods it must be noted that any trade discount allowed in the original transaction must be taken into consideration and only net value of goods returned must be recorded.Debit note: A ‘Debit Note’ is a serial wise document, bill or statement sent to the person to whom goods are returned or from whom an allowance is claimed. This statement informs him that his account is debited to the extent of the value of goods returned or allowance claimed.

Like the purchase book the purchase return book is closed periodically and the entries there in are posted to the ledger as under:

Debit supplier account to whom goods are returned as “To purchase return A/c”.

Credit the purchase return Account with the periodical total as “By Sundries”.

3. SALES BOOKS

Sale book or sales journal records only credit sale of goods in which business deals with. Cash sales of goods and sale of property and assets whether for cash or credit are not recorded in sales day book.Sales book is closed periodically and entries there from are posted to the ledger as under:

Debit customer’s Account as “To Sales A/c”

Credit sales account with periodical total as “By Sundries as per sales book”.

4. SALES RETURN BOOK

Whenever goods sold on credit are returned by customers, they are recorded in sales return book.Credit Note: When the seller receives back goods from the purchaser along with a Debit Note the seller has to acknowledge the same by sending a Credit Note confirming the acceptance of the debit note. In other words it is a statement sent by the seller to the purchaser after the receipt of goods returned by purchaser. We call it a Credit Note, because the customer’s account is credited with the amount written therein.

Like sales book, this book is also closed periodically and entries are posted to the ledger as under:

Debit Sales return account with the periodical total as “To Sundries”

Credit customer account with the individual amount as “By Sales return A/c”

EXAMPLE PROBLEM

Let’s say you are dealing in textile business, to run the business you will first purchase the raw material right after that your company will make a new product and sale it to the customers. So we prepare separate purchase book purchase return book sales book and sales return book, instead of clubbing all the entries in one journal.Now let me explain the above transactions one by one:

On Jan 1 goods are purchased from Madan that means it is a credit transaction so we will record it in purchase book, remember only credit transactions are recorded in purchase book. And you must remembered that we can’t use purchase in purchase book instead we will write the name from whom we purchase; this rule is applicable to all books. Here there is a trade discount of 10% on 3000 worth of goods so we will deduct it and record the net amount only that is 2,700 - because no separate entry is made for trade discount.

On Jan 2 we return goods worth 200 to Madan so it is a purchase return, remember there was a trade discount so we will deduct trade discount from the purchase return as well, that is 180.

Again On Jan 2 sold goods to Madan that means it is a credit transaction so we will record it in sales book, as Madan with its respective amount.

On Jan 5 goods are returned by Madan so recorded in sales return book, as Madan with its respective amount.

On Jan 13 goods are sold to Hari, it should be recorded in sales book. Here there is a trade discount of 10% on 2000 worth of goods so we will deduct it and record the net amount only that is 1,800, because no separate entry is made for trade discount.

On Jan 14 Hari return goods which was sold to him that means we will record it in sales return book, remember there was a trade discount so we will deduct trade discount from the sales return as well that is 90.

On Jan 19 sold goods to Madan so we will record it in sales book, as Madan with its respective amount.

On Jan 28 sold goods to Hari so we will record it in sales book, as Hari with its respective amount.

On Jan 29 goods are purchase from Hari so we will record it in Purchase book as Hari with its respective amount.

On Jan 30 goods are return to Hari so it is a purchase return. We will record it in purchase return book, as Hari with its respective amount.

Solution:

Now let’s look to our subsidiary books below:On Jan 1 and 29 there was a purchase made so recorded in purchase book.

On Jan 2 and 30 there were purchase return so recorded in purchase return book.

On Jan 2, 13, 19, and 28 sales were made so recorded in sales book.

On Jan 5 and 14 there were sales return so recorded in the sales return book.

Later All four books are closed periodically and entries there from are posted in to separate ledgers.

Comments

Post a Comment